Investing in Dubai’s Off Plan Properties: Pros, Cons and Strategies!

Dubai’s skyline, a dazzling mix of futuristic architecture and towering skyscrapers, has long been a magnet for real estate investors. Among the various investment avenues, off-plan properties—a.k.a. buying properties before they’re built—offer a unique blend of risk and reward. Let’s dive into the latest trends, advantages, pitfalls, and smart strategies for investing in Dubai’s Off Plan Properties.

Dubai’s Current Real Estate Market Landscape

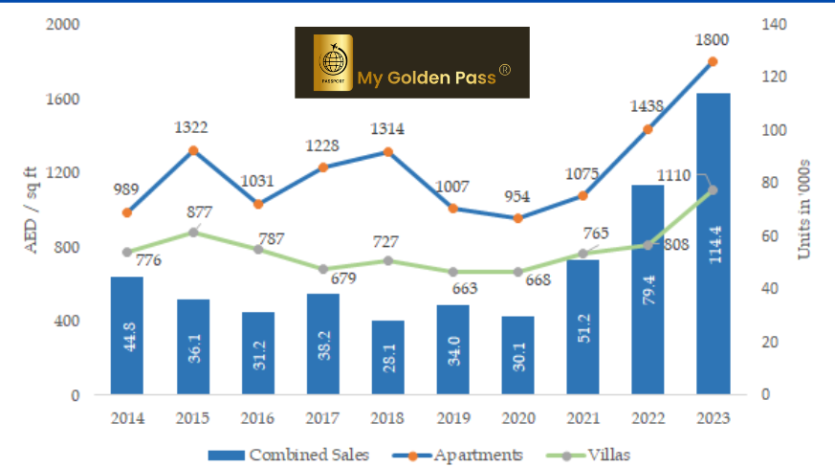

As of mid-2024, Dubai’s off-plan property market is witnessing robust activity. The city’s ambitious Vision 2040 plan aims to create a sustainable urban environment, further boosting real estate prospects. Key areas of interest include Dubai Creek Harbour, Mohammed Bin Rashid City, and the newly announced projects along the Dubai South development corridor.

Additionally, Expo 2020’s legacy continues to influence the market positively, with increased infrastructure development and heightened global interest in Dubai as a prime investment destination. Developers are introducing innovative projects with a focus on smart home technologies, eco-friendly designs, and mixed-use communities.

Pros of Dubai’s off plan properties:

- Price Advantage: One of the most attractive aspects of off-plan properties is the lower price compared to completed projects. Developers often offer early bird discounts, making it an affordable entry point into the market.

- Payment Flexibility: Developers typically offer flexible payment plans. Instead of paying the full amount upfront, investors can pay in stages throughout the construction period, easing the financial burden.

- Capital Appreciation: With Dubai’s real estate market on a growth trajectory, off-plan properties can appreciate significantly in value by the time of completion, offering substantial returns on investment.

- Customization: Buying off-plan allows investors to customize the property to their liking, choosing finishes and layouts that meet their personal or market demands.

Cons of Dubai’s off plan properties!

- Completion Risk: There’s always a risk that the project might be delayed or, in worst-case scenarios, not completed at all. This risk underscores the importance of researching the developer’s track record. However, Dubai Land Department and RERA has strict regulations on delayed projects. So, don’t worry you will still be safe with your capital.

- Market Fluctuations: The value of off-plan properties can fluctuate based on market conditions. An economic downturn could affect the potential resale value.

- Lack of Immediate Rental Income: Unlike ready properties, off-plan investments do not generate rental income until the project is completed, which could take several years.

Strategies for Savvy Dubai Investors

- Research the Developer: Due diligence is crucial. Investigate the developer’s history, previous projects, and financial health. Well-established developers are less likely to face delays or defaults.

Suggestion: You could look into properties by Emaar, Nakheel and Aldar Athlon as they are well established.

- Location, Location, Location: Prime locations are key to high returns. Look for projects in areas with strong infrastructure, amenities, and future growth potential. Emerging neighborhoods with planned developments can also offer lucrative opportunities.

- Understand the Market Cycle: Timing your investment can make a significant difference. Entering the market during a down cycle can mean lower prices and higher potential for appreciation when the market recovers.

- Review the Contract Carefully: Ensure that the contract includes clear terms regarding completion dates, compensation for delays, and the developer’s obligations. It’s wise to seek legal advice before signing.

- Exit Strategy: Have a clear exit strategy. Whether you plan to sell upon completion for a profit or hold the property for rental income, having a defined plan will help you make informed decisions.

So, whether you’re a seasoned investor or a first-time buyer, off-plan properties in Dubai are certainly worth considering for your investment portfolio.

If you are planning to invest in Dubai’s Off Plan Properties, you can contact Casa Key Real Estate to help you sort out all plans and confusions!